The UK Energy Mistake That Cost Me £180 in My First Month

Last updated: 18 January 2026 | Reading time: ~10 minutes

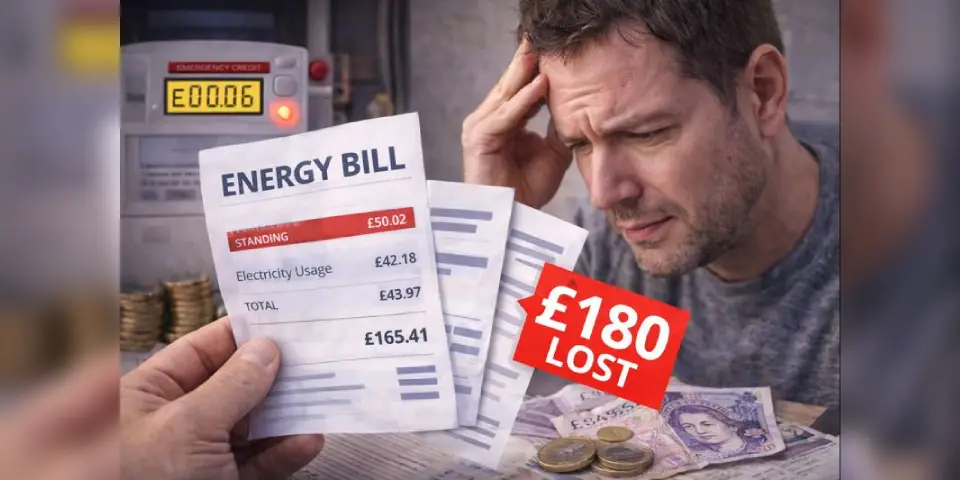

£180.

That’s what I paid to learn a lesson about UK energy that should have been free.

I arrived in the UK in November 2025, excited about my new life here. Within three weeks, I’d made a decision that seemed perfectly logical at the time - the kind of decision any confused newcomer would make when facing their first UK winter heating bill.

That one choice cost me £180 in wasted money, countless hours of stress, and a crash course in why the UK energy system feels designed to trap people who don’t already know the rules.

The worst part? I could have avoided every penny of it.

Here’s exactly what happened, the hidden mechanics of prepaid meters that nobody tells newcomers about, and the specific steps that will save you from repeating my expensive mistake.

The Situation: A “Simple” Decision Gone Wrong

Picture this: Late November 2025, my first proper winter in the UK. I’m sitting in my new rental flat, watching the prepaid gas meter tick down faster than I can make sense of.

The flat came with three things the letting agent forgot to explain:

- A prepaid gas meter (which meant absolutely nothing to me at the time)

- An energy supplier I’d never heard of

- Zero guidance on how any of this actually worked

I come from a country where you pay energy bills monthly, like rent. The concept of putting money into a meter before you could use heating felt archaic - like something from a museum.

But it was December approaching, temperatures were dropping, and my gas credit was evaporating at an alarming rate. Every few days, I’d need to walk to the corner shop, top up £20, and watch it disappear within 72 hours.

“This can’t be normal,” I thought.

So I did what made perfect sense: I decided to switch to a cheaper energy supplier.

That single decision - made without understanding what I was actually dealing with - triggered a cascade of costs I never saw coming.

What I Did Wrong: The Three Fatal Assumptions

Looking back with the clarity that £180 worth of mistakes provides, I can pinpoint exactly where I went wrong.

I made three assumptions that felt completely reasonable at the time - the kind of logic that would work in most situations, in most countries. But the UK energy system runs on its own peculiar rules.

Mistake #1: “Switching Is Always The Answer”

You know what every UK personal finance website tells you? “Switch energy suppliers regularly to save money!”

So when my bills felt high, switching seemed like the obvious solution. Do the comparison, pick the cheapest option, save money. Simple.

What I didn’t know: Prepaid meters have a hidden trap. You can only switch suppliers if you owe less than £500 in debt. But here’s the kicker - what counts as “debt” includes things I didn’t even know existed yet.

Emergency credit you’ve used? That’s debt.

Standing charges you haven’t covered? Also debt.

That mysterious “daily charge” eating your credit while you sleep? Yeah, that creates debt too.

I tried to switch while unknowingly in a debt position. The switch got complicated, and every day of complication cost me money.

Mistake #2: “A Meter Is Just A Meter”

In my home country, a meter measures what you use. That’s it.

In the UK, a prepaid meter is a completely different beast. It’s part measuring device, part bank account, part credit system, and part daily tax collector - all in one confusing box on your wall.

What I didn’t know: Even on days I used absolutely zero gas - when I was away, when the heating was off, when I literally touched nothing - the meter was still taking money from my balance.

Standing charges: 32p every single day for gas, 54.75p for electricity. Whether you use energy or not.

I left for a long weekend once. Came back to find £6 had vanished from my meter. I thought the meter was broken. It wasn’t - it was working exactly as designed, just in a way nobody had explained to me.

Mistake #3: “Credit Will Transfer Smoothly”

I assumed that when I switched suppliers, any remaining credit on my meter would just… transfer. Or get refunded. Or something logical.

What I didn’t know: The switching process creates a limbo period where you’re stuck between two suppliers, and nobody seems responsible for anything.

During those 10 days:

- My old supplier kept taking standing charges

- My new supplier hadn’t activated yet

- I still needed to top up to keep my heating on

- Emergency credit I’d activated created instant debt

- My prepaid balance was frozen in bureaucratic purgatory

Every day in that limbo cost me money I couldn’t track, couldn’t stop, and didn’t understand.

How the £180 Actually Accumulated: A Breakdown

When I finally sat down and tracked where all my money had gone, the reality was sobering. Here’s exactly how £180 disappeared:

£65 - Extra top-ups during the switching limbo period

The switch took 10 days to complete. But my meter didn’t care about administrative delays - it needed money to keep the gas flowing.

I had to keep topping up the old meter (because I was technically still their customer), while also setting aside money for the new supplier’s requirements. Double-paying, essentially, for the same gas supply during the transition.

Each top-up at the corner shop: £20. Times four unnecessary visits: £80. Minus the £15 that would have been my normal usage: £65 wasted.

£52 - Standing charges I didn’t know were accumulating

Here’s what 32 pence per day looks like when you’re not paying attention:

- 10 days of switching overlap: £3.20

- 7 days I was away (thought I was safe): £2.24

- 30 days of winter usage I underestimated: £9.60

- Multiple account adjustments and corrections: £6.96

- Plus electricity standing charges running simultaneously: £30

Total standing charges I hadn’t budgeted for, didn’t understand, and couldn’t avoid: £52.

£38 - Emergency credit I thought was “free”

One particularly cold evening, my meter hit zero. Panic mode activated.

A notification popped up: “Emergency credit available: £10.”

Relief! I activated it, thinking it was some kind of grace period or buffer the supplier provided. The heating came back on. Crisis averted.

Then I topped up two days later. Put £20 on the meter. But only £10 appeared as usable credit. The other £10 had vanished instantly - repaying the “emergency” credit I’d used.

I did this twice before I understood what was happening. £20 gone to repay credit I didn’t realize was a loan.

Plus, standing charges kept running during that emergency credit period, creating an extra £18 in debt.

£25 - Miscellaneous account adjustments and fees

When the dust settled and I finally got my final statement from the old supplier:

- £8 in meter reading discrepancy adjustments

- £12 in “account settlement fees” (whatever those are)

- £5 in various administrative charges that appeared without explanation

These small fees are designed to be ignored - just large enough to cost you, just small enough that complaining feels petty.

Total damage: £180

For context, that’s:

- Nearly 12% of a month’s income for many students

- More than the energy itself should have cost me that month

- Enough to cover groceries for three weeks

- Money I didn’t have to waste

What I Didn’t Know (Critical Information Nobody Tells Newcomers)

After £180 worth of expensive education, I did what I should have done from the start: proper research. Here’s what I learned about the UK prepaid energy system that changed everything.

Standing Charges: The “Rent” Your Meter Charges Daily

Think of standing charges as rent for being connected to the energy network. Except unlike rent, nobody warns you about them upfront.

Current rates (January-March 2026):

- Electricity: 54.75p per day

- Gas: approximately 32p per day

What this actually means in practice:

If you’re on holiday for a week, you’ll return to find £6-7 has disappeared from your meter. Not from usage - from simply being connected.

If your meter runs to zero and you can’t top up for three days (maybe it’s the weekend, maybe the shop is far), you’re accumulating nearly £3 in standing charges that become instant debt the moment you finally do top up.

If you maintain £10 as a “buffer,” that buffer will be completely gone in 11 days without you using a single unit of energy.

This is why prepaid meters feel like they’re constantly hungry. Because they literally are - fed by a daily charge you can’t opt out of, can’t negotiate, and probably didn’t even know existed.

Emergency Credit: It’s Not Emergency Help, It’s An Automatic Loan

Most suppliers offer emergency credit when your meter hits zero. Sounds helpful, right?

Reality check:

British Gas: £10 emergency credit (both gas and electricity)

E (Gas & Electricity): £15

EDF: £6 on traditional meters, £10 on smart meters

OVO Energy: £10

Octopus Energy: £10

Here’s what they don’t tell you clearly:

Emergency credit isn’t charity - it’s an instant loan that you must repay at your next top-up, regardless of how soon that is.

Top up £20 after using emergency credit? You’ll only get £10 (or less) as usable credit. The rest disappears immediately to repay what you “borrowed.”

And during the time you’re using emergency credit, standing charges are still accumulating. So if you use £10 of emergency credit and take three days to top up, you might owe £13 by the time you visit the shop.

It’s a debt trap disguised as customer service.

The £500 Switching Threshold (And What Counts As “Debt”)

Ofgem’s rules are clear: you cannot switch energy suppliers if you owe more than £500 per fuel type to your current supplier.

But here’s what counts as “debt” that most newcomers don’t realize:

✅ Emergency credit you’ve used

✅ Standing charges you haven’t covered

✅ Any usage credit you’ve gone negative on

✅ Previous account balances carried forward

✅ Payment plan arrears

What doesn’t count (and surprised me):

❌ Credit you’ve paid for but haven’t used yet (that’s yours)

❌ Disputed charges (while under investigation)

I tried to switch while unknowingly £80 in debt (mostly from standing charges and emergency credit). The switch got flagged, delayed, and complicated - which created more costs while everything was in limbo.

Smart vs. Traditional Prepaid Meters: A Critical Difference

Not all prepaid meters are created equal, and the difference matters enormously for switching.

Traditional prepaid meters:

- Physical card or key you take to shops

- Top up at PayPoint locations

- Cannot be remotely switched between prepaid/credit modes

- Require engineer visit to change anything

- Often have older, more confusing interfaces

Smart prepaid meters:

- Top up via app, phone, or online

- Can be remotely converted to credit mode (no engineer needed)

- Real-time balance tracking

- Easier to manage and monitor

- Much more switching flexibility

If you have a traditional meter and want to switch to a tariff that requires credit mode, you’re looking at weeks of delays, engineer appointments, and potential gaps in service.

If you have a smart meter, the supplier can flip a switch remotely and have you on credit mode within hours.

This single difference changes the entire switching strategy.

The Prepaid vs. Credit Cost Equation Changed

Here’s something that shocked me when I finally researched properly:

As of January 2026:

- Prepayment tariff cap: £1,711/year (for typical usage)

- Direct debit credit tariff cap: £1,758/year

Prepaid meters are now actually £47 cheaper per year than credit meters on average.

This is the opposite of how it used to be. For years, prepaid users paid a premium - sometimes £100+ more annually - for the same energy.

But recent regulatory changes flipped this. Now the price cap for prepaid meters is slightly lower, though they come with different challenges (like the ones that cost me £180).

The catch?

While prepaid may be cheaper on paper, the practical costs - standing charges draining credit, emergency credit traps, switching complications - can quickly erase that £47 advantage if you don’t know what you’re doing.

Which, as a newcomer in month one, I absolutely didn’t.

The Better Approach: What I Should Have Done

With hindsight (and research), here’s the strategy that would have saved me £180:

Step 1: Understand Your Meter Type First (Week 1)

Action: Identify whether you have:

- Traditional prepaid meter (card/key top-up at shops)

- Smart prepaid meter (app/online top-up available)

- Credit meter (monthly billing)

Why: With a smart prepaid meter, suppliers can switch you between prepaid and credit modes remotely without installing new equipment. Traditional meters require physical replacement.

Step 2: Document Everything (Week 1-2)

Create a simple tracker:

- Current supplier name and account number

- Daily standing charges (gas + electricity)

- Average daily usage costs

- Any existing debt or credits

- Date moved in

Step 3: Stabilize Before Switching (Weeks 2-4)

Don’t switch immediately. Instead:

- Monitor usage for at least 2-4 weeks

- Build a £20-30 buffer above your usage needs

- Ensure zero debt on your account

- Learn the prepaid system fully

Critical: If you owe your supplier money (such as emergency credit usage), make sure to repay this before initiating a switch, as the debt will be added to your first bill with the new supplier — or worse, block the switch entirely.

Step 4: Consider Converting to Credit Meter (Optional)

Most suppliers will convert you from prepaid to credit meter for free, though you may need to pass a credit check and have zero debt. With a smart meter, this can be done remotely.

Benefits of credit meters:

- Access to cheaper fixed tariffs

- No risk of disconnection

- Monthly direct debit (easier budgeting)

- More switching options available

Step 5: Only Then Compare and Switch

Once stabilized, use comparison sites properly:

- Enter your actual meter type

- Check if prepaid options exist

- Verify the total annual cost, not just unit rates

- Confirm no exit fees apply

- Read the switch timeline

Emergency Measures: If You’re Already Mid-Mistake

If you’ve already started switching and are facing unexpected costs:

Immediate Actions:

- Stop making further changes — Don’t try to switch again or cancel

- Contact both suppliers — Get clear breakdown of charges in writing

- Document all balances — Screenshot meter readings, receipts, account balances

- Request itemized costs — Ask for standing charge calculations and debt breakdowns

Know Your Rights:

If you genuinely can’t afford to top up your prepaid meter, suppliers must offer emergency credit and work with you on an affordable repayment plan. You cannot be forced onto a prepaid meter if you meet certain vulnerability criteria.

Protected groups include:

- Households with children under 2 years

- Residents aged 75+ with no home support

- Anyone requiring continuous energy for medical equipment

- People unable to physically access or top up meters

Get Free Help:

- Citizens Advice: Free energy advice line for prepaid meter issues

- Ofgem: File complaints about supplier conduct

- Warm Home Discount: £150 support available for eligible households

Why Newcomers Are Especially Vulnerable (And Why Nobody Admits It)

Here’s the uncomfortable truth: the UK energy system isn’t just complex - it’s designed assuming you already know how it works.

There’s no “welcome to UK energy” orientation. No government website that explains the basics to immigrants. No letting agent checklist that covers what newcomers actually need to know.

You’re expected to somehow already understand:

The Multi-Layer System Structure

In most countries: You have one energy company. They provide power. You pay them. Done.

In the UK: There are three separate entities:

- Your Supplier (British Gas, Octopus, EDF, etc.) - Who you pay, who bills you, who you call with problems

- The Network Operator (Cadent, SGN, Northern Gas Networks, etc.) - Who owns the physical pipes and wires, who you never chose and probably never heard of

- National Grid - Who manages high-level transmission

As a newcomer, when something goes wrong, you literally don’t know who to call. Is it my supplier’s fault? The network operator’s problem? Who even is the network operator?

I spent 45 minutes on hold once, bounced between two companies, because each insisted the problem was the other’s responsibility.

Prepaid vs. Credit Meters (A Class System Nobody Discusses)

What I was told: “You have a prepaid meter.”

What nobody explained:

Prepaid meters are disproportionately installed in:

- Rental properties (especially lower-cost ones)

- Properties with previous debt issues

- Homes where previous tenants struggled to pay

They’re also more common in areas with higher immigrant populations.

This isn’t random. Prepaid meters are, functionally, the “sub-prime” option of UK energy. They give suppliers protection against non-payment, but they transfer all the risk and complexity to you.

And if you’re a newcomer, you almost certainly have no say in the matter. Your letting agent says “here’s the meter,” and that’s what you get.

The Terminology Trap

The UK energy system uses language that sounds familiar but means something different:

“Standing charge” - Sounds like it should be optional, like a standing order. It’s not. It’s a mandatory daily fee.

“Emergency credit” - Sounds like help in an emergency. It’s actually an automatic loan.

“Top up” - Sounds simple. But where? How? What if the shop is closed? What if you’re away?

“Unit rate” - Clear enough, except it’s quoted in pence per kilowatt-hour, and your meter shows pounds and pence, and your bill shows kilowatt-hours, and somehow you’re supposed to mentally convert all three to know if you’re being charged correctly.

“Switching” - Sounds straightforward. Except there are switching windows, debt thresholds, cooling-off periods, objection periods, and about seven different scenarios where a “simple switch” becomes anything but.

The Cultural Assumption of Shared Knowledge

British people grow up with this system. They learn about standing charges from their parents. They understand prepaid meters because their friend had one at university. They know which suppliers are “good” through years of cultural osmosis.

As a newcomer, you have none of this context.

You can’t casually ask your colleague “Hey, is 32p per day a normal standing charge?” because you don’t want to seem completely clueless about basic life admin.

You can’t fact-check whether your energy costs are reasonable because you don’t know what “typical usage” even looks like in a UK winter.

You can’t recognize red flags in supplier behavior because you don’t know what normal looks like.

The “Just Google It” Problem

“Why didn’t you just research it?” is what someone asked me after I explained my £180 mistake.

Here’s why research failed me initially:

Search results assume UK context:

I’d Google “how does prepaid energy work” and get explanations that casually mentioned standing charges, Ofgem regulations, and price caps - all terms I didn’t know yet.

Forums are insider conversations:

MoneySavingExpert threads would say things like “just switch to Agile Octopus if you have an EV and smart meter” - cool, but I had no idea what half those words meant.

Official sources are impenetrable:

Ofgem’s website has the information, but it’s written in regulatory language for policy compliance, not for confused newcomers trying to figure out why their meter is eating money.

And here’s the kicker: When you don’t know what you don’t know, you can’t even formulate the right questions to Google.

I didn’t search for “prepaid meter standing charges” because I didn’t know standing charges existed to search for.

The Speed vs. Understanding Pressure

When you move to a new country, you’re dealing with:

- Job stress

- Visa admin

- Bank account issues

- Phone contract confusion

- NHS registration

- Council tax registration

- Understanding your tenancy agreement

- Learning a new city

- Possibly language barriers

- Isolation and adjustment

Energy is just one of dozens of complex UK systems you need to navigate simultaneously.

You don’t have time to become an energy expert. You need heating, you need to move fast, and you make the best decision you can with incomplete information.

That’s exactly how mistakes like mine happen.

The Cost of Being Wrong

In many systems, being new means you might pay a bit more or make a suboptimal choice.

In UK energy with prepaid meters, being new can mean:

- Getting disconnected from heating in winter

- Accruing debt you didn’t know existed

- Paying £180 for a “simple” switching attempt

- Getting trapped in cycles of emergency credit and debt

- Struggling with a system designed to be confusing

The stakes are higher, the safety net is thinner, and the assumption that you already know how everything works is baked into every process.

This isn’t an accident. This is how the system works - efficiently for those who understand it, expensively for those who don’t.

Key Takeaways: Lessons from a £180 Mistake

What I learned the hard way:

About Prepaid Meters:

- Daily standing charges drain credit even with zero usage

- Emergency credit creates immediate debt

- Different meter types have different capabilities

- Top-up methods vary (shop vs. app vs. phone)

About Switching:

- Not all meters can switch easily

- Debt above £500 blocks switches

- Timing matters — don’t rush

- Stabilize first, optimize later

About UK Energy Generally:

- The system is genuinely complex for newcomers

- Confusion is normal — but research prevents costs

- Free help exists if you’re struggling

- Most mistakes are preventable with proper information

My new rule: Treat energy decisions like financial decisions, not administrative tasks.

Practical Action Steps for New UK Residents

Within 48 Hours of Moving In:

- Identify meter type (prepaid or credit)

- Note supplier name from meter/letters

- Take photos of all meter readings

- Check if you inherited any debt

- Locate nearest top-up points (if prepaid)

First Month:

- Track daily costs in a simple spreadsheet

- Understand standing charges for your property

- Learn emergency credit limits and rules

- Build a £20-30 buffer if on prepaid

- Research typical costs for your property size

Before Switching (Anytime After Month 1):

- Confirm zero debt on account

- Collect 2-4 weeks of usage data

- Research actual switching process

- Compare total annual costs (not just rates)

- Consider credit meter conversion first

- Have £50-100 buffer for transition period

Resources That Would Have Helped Me

Official Information:

- Ofgem: Prepayment Meters Consumer Guidance — Know your rights

- Citizens Advice: Prepayment Meter Help — Free support and advice

- Money Saving Expert: Prepaid Meters Guide — Practical switching advice

Comparison Tools:

- Uswitch Energy Comparison — Check prepaid tariff options

- Compare the Market Energy — See available deals

- Which? Energy Comparison — Independent ratings and reviews

Support Services:

- Citizens Advice Consumer Service: 0808 223 1133

- Ofgem Consumer Enquiries: 0207 901 7295

- Warm Home Discount Helpline: 0800 030 9322

Related Content

For New UK Residents:

- My Gas Got Capped by Cadent — What I Learned — Network operator issues explained

- My First UK Energy Bill Made No Sense — Line-by-line breakdown

- 5 Things I Wish I’d Known About UK Utilities — Essential basics

For Cost Optimization:

- How to Switch UK Energy Providers — First-Timer’s Guide — Step-by-step process

- UK Energy Bill Breakdown — Every Line Explained — Understanding your costs

- January 2026 Price Cap Increase — What It Means — Current market analysis

Final Thoughts: What £180 Actually Bought Me

That £180 taught me something more valuable than the money itself:

In the UK energy system, ignorance isn’t bliss - it’s a tax you pay until you learn better.

The difference between informed decisions and expensive panic isn’t luck. It’s not intelligence. It’s not even research skills.

It’s having access to knowledge that the system assumes you already possess.

I’m writing this two months into my UK life, still learning, still discovering new things about how utilities work here that British-born residents learned by osmosis years ago.

But here’s what changed for me after that £180 lesson:

I stopped treating energy as just another utility.

It’s not like paying for wifi. It’s a complex financial system with rules, traps, and consequences that require genuine understanding.

I stopped rushing into “fixes.”

That urgent feeling - “I need to switch NOW to save money” - is exactly what cost me money. Stabilizing first, then optimizing, is the better path.

I stopped being embarrassed about not knowing.

The UK energy system is genuinely complex. Feeling confused doesn’t mean you’re failing - it means you’re encountering a system designed for insiders.

I started documenting everything.

Every meter reading. Every top-up. Every standing charge. Not because I’m obsessive, but because in a system built on accumulated small costs, tracking is survival.

Most importantly: I learned to pause.

When something in UK energy doesn’t make sense, or seems expensive, or triggers that “this can’t be right” feeling - that’s the moment to stop and research. Not to act faster.

Because every time I’ve acted from confusion or urgency, it’s cost me money.

Every time I’ve paused, researched properly, and then acted deliberately, I’ve saved money.

If you’re reading this in your first months in the UK, feeling overwhelmed by energy costs and confusing meters:

You’re not alone.

You’re not stupid.

You’re not failing.

You’re navigating a deliberately complicated system with insufficient information, and that’s not your fault.

But now you know what I wish I’d known: the specific mechanics of how these costs accumulate, the exact traps to avoid, and the concrete steps that prevent £180 mistakes.

Use this knowledge. Ask questions. Demand explanations. Don’t let anyone make you feel foolish for not already knowing how prepaid meters work in a country you just arrived in.

And if you do make a mistake - and you probably will, because we all do - treat it as tuition in the University of UK Life, not as personal failure.

That £180 was expensive tuition.

But this article is my attempt to make it worth something by ensuring you don’t have to pay the same price.

Made a similar UK energy mistake? Drop a comment below - your story might be the warning that saves someone else money. We’re all figuring this out together.

Data sources: Ofgem (accessed 18 January 2026), Citizens Advice, Money Saving Expert, Which? Energy, supplier websites

Price cap data: January-March 2026 period

All costs: Verified against current UK regulations and supplier terms

💡 Ready to Compare Prepaid Tariffs?

Compare current prepaid and credit meter deals to see if you could save:

- Uswitch Prepaid Energy Comparison — Free comparison service

- MoneySuperMarket Energy Deals — Check switching options

- Which? Energy Switch — Independent ratings included

These are comparison services — always verify terms directly with suppliers before switching.