Date

January 17, 2026

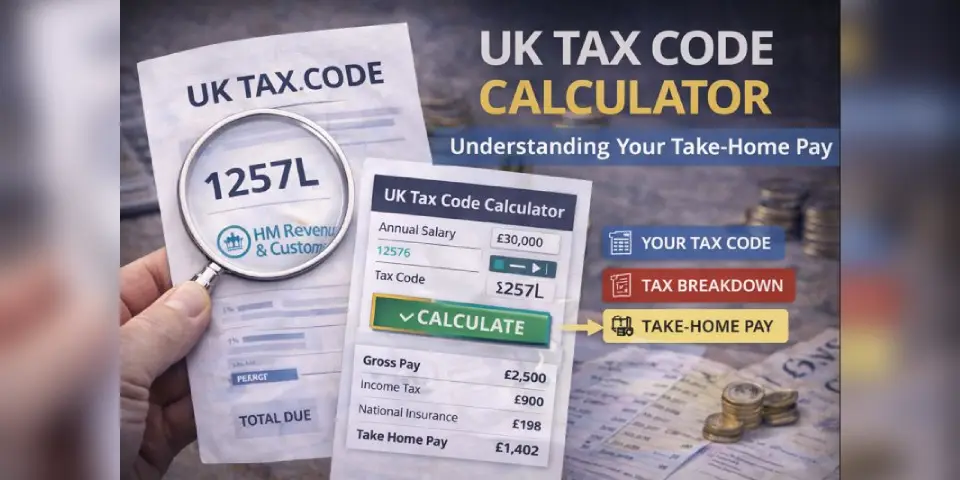

Tool Overview

The UK Tax Code Calculator turns confusing payslip numbers into clear answers about your actual take-home pay. But as a newcomer to UK tax, the confusing part is everything around it: tax codes, allowances, NI contributions, and tax bands.

This guide gives you a safe, step-by-step process to use the calculator and understand your results—designed to help you spot the two biggest problems people face:

- Being on the wrong tax code (leading to overpaid tax)

- Not understanding deductions (causing budget confusion)

By the end, you’ll know exactly how to use the calculator before, during, and after major life changes.

Key Lessons

-

Know Your Tax Code First (so you don’t waste time)

- Where to find your tax code on your payslip

- What the numbers and letters actually mean

- Common codes: 1257L (standard), BR (emergency), S1257L (Scottish)

-

Calculate Accurately

- How to enter your gross salary correctly

- Understanding tax-free allowance vs taxable income

- Reading the tax band breakdown

-

Use Results Safely (and protect yourself from overpaying)

- What to check on your actual payslip

- How to spot emergency tax

- When to contact HMRC for a refund

Tools & Frameworks

- The Calculator itself (with save/print features)

- A “Tax File” (simple records you keep)

- Payslip comparison checklist

Why It Matters

- Know your worth by understanding true take-home pay before accepting job offers

- Avoid overpaying by spotting incorrect tax codes early

- Budget accurately with real numbers, not estimates

Practical Exercise

Do a “dry run” with the calculator:

1) Gather your details (5 minutes)

- Your current tax code (from latest payslip)

- Your annual gross salary (before any deductions)

- Your pay frequency (monthly/weekly/annual)

2) Identify your tax situation (5 minutes)

- Standard UK taxpayer (England, Wales, Northern Ireland)

- Scottish taxpayer (S prefix on tax code)

- Emergency tax (BR, 0T, D0, D1 codes)

- Special circumstances (K codes, high earner)

3) Run the calculation (2 minutes)

- Enter your tax code

- Enter your salary

- Select pay frequency

- Click “Calculate Take-Home Pay”

The Step-by-Step Calculator Guide

Step 1: Enter Your Tax Code

In the Tax Code field:

- Type exactly as shown on your payslip

- Common examples:

1257L,S1257L,BR,K500 - If you don’t have a payslip yet, start with

1257L(standard)

Where to find it: Top section of your payslip, labeled “Tax Code”

Step 2: Enter Your Annual Salary

In the Annual Gross Salary field:

- Enter your yearly salary before tax

- Don’t include bonuses unless they’re guaranteed

- Use whole numbers (e.g., 35000 not 35,000.00)

Important: This is gross salary (before deductions), not take-home pay

Step 3: Select Pay Frequency

Choose how often you’re paid:

- Monthly (most common for salaried workers)

- Weekly (common for hourly/contract workers)

- Annual (for yearly overview)

Step 4: Review Your Results

The calculator shows:

- Tax-free allowance: What you keep (usually £12,570)

- Taxable income: What gets taxed

- Income tax: Your tax bill

- National Insurance: Your NI contributions

- Take-home pay: What hits your bank account

Step 5: Save or Print (optional)

- Click ”💾 Save as PDF” to download results

- Click “🖨️ Print Results” for a paper copy

Understanding Your Results

The Main Numbers

Tax-Free Allowance

- Standard: £12,570 for 2024/25

- Reduces if you earn over £100,000

- Negative for K codes (you owe extra tax)

Tax Bands (England, Wales, NI)

- 0% on first £12,570 (Personal Allowance)

- 20% on £12,571 to £50,270 (Basic Rate)

- 40% on £50,271 to £125,140 (Higher Rate)

- 45% on over £125,140 (Additional Rate)

Scottish Tax Bands (if code starts with S)

- 19% Starter Rate

- 20% Basic Rate

- 21% Intermediate Rate

- 42% Higher Rate

- 47% Advanced Rate

National Insurance (2024/25)

- 8% on earnings between £12,570 and £50,270

- 2% on earnings above £50,270

Common Problems (and what to do)

“My actual take-home is less than the calculator shows”

Common causes:

- Pension contributions (not included in calculator)

- Student loan repayments (not included)

- Other workplace deductions

What to do:

- Check your payslip for “Additional Deductions”

- Subtract pension/student loan amounts from calculator result

- This gives you a more accurate take-home figure

”I’m on BR code and paying loads of tax”

You’re on emergency tax—temporary but fixable.

What to do:

- Contact HMRC (0300 200 3300)

- Provide your P45 from previous employer (if you have it)

- Once corrected, claim refund for overpaid tax

”My tax code changed—what does it mean?”

Tax codes change for various reasons:

- Pay rise or promotion

- Company benefits (car, health insurance)

- Marriage Allowance transfer

- HMRC correction

What to do:

- Use the calculator with your new code

- Compare with your old code results

- If it seems wrong, contact HMRC to verify

”I earn over £100k—my allowance is wrong”

High earners lose £1 of allowance for every £2 earned above £100,000.

What to do:

- The calculator handles this automatically

- Example: £110,000 salary = £7,570 allowance (not £12,570)

- Check the “Tax-Free Allowance” result confirms this

Try These Scenarios

Test the calculator with real examples:

Scenario 1: Entry-Level Job

- Tax Code: 1257L

- Salary: £25,000

- Expected Result: ~£21,550 take-home (£1,795/month)

Scenario 2: UK Average Salary

- Tax Code: 1257L

- Salary: £35,000

- Expected Result: ~£28,280 take-home (£2,357/month)

Scenario 3: Scottish Taxpayer

- Tax Code: S1257L

- Salary: £40,000

- Expected Result: Slightly less than English equivalent due to different bands

Scenario 4: Emergency Tax

- Tax Code: BR

- Salary: £30,000

- Expected Result: Much lower (all taxed at 20%, no allowance)

Scenario 5: High Earner

- Tax Code: 1257L

- Salary: £120,000

- Expected Result: See allowance tapering in action (£2,570 allowance only)

When to Use the Calculator

Before Accepting a Job Offer

- Calculate real take-home from the offered salary

- Compare multiple offers accurately

- Factor in location cost-of-living

When Your Tax Code Changes

- Verify the change is correct

- See impact on monthly budget

- Decide if you need to contact HMRC

Before Salary Negotiations

- Understand marginal tax rates

- See real value of pay rises

- Know your worth in take-home terms

When Moving to Scotland

- Compare English vs Scottish tax implications

- Understand the different band structure

- Budget for slightly higher tax (typically)

If Suspecting Overpayment

- Calculate what you should be paying

- Compare with actual payslip deductions

- Build case for HMRC refund claim

Key Takeaways

- Tax codes are instructions to your employer, not random letters

- The bigger the number, the more you earn tax-free

- Emergency codes (BR, 0T) mean you’re overpaying—fix it fast

- Scottish taxpayers (S prefix) pay different rates

- High earners (£100k+) lose allowance gradually

- Calculator estimates tax + NI only—pension/loans are separate

Next Steps

- Understanding UK Payslips: Line-by-Line Breakdown

- How to Claim a Tax Refund from HMRC

- Tax Codes Explained: Every Letter and Number

- Scottish vs English Tax: A Complete Comparison